How to Avoid Private Mortgage Insurance with less than 20% down payment

Homebuyers Don’t Have to Wait Until They Have a 20% Down Payment

Are you waiting to purchase a home because you don’t have 20% to put down in order to avoid paying private mortgage insurance (PMI)? The wait is over because we have mortgage programs which allow for as little as 5% down and feature no monthly PMI! Instead, customers can choose a Single Premium Buyout Option.

PMI is required on many mortgage programs when the borrower is not putting down at least 20%. The insurance protects the lender against a borrower who may stop making their monthly mortgage payments. The cost of PMI to a borrower is between $30 to $70 per month per each $100,000 borrowed. PMI is removed from a mortgage once the loan-to-value of the loan reaches approx. 80%.

The Single Premium PMI Buyout Option allows a borrower to pay the insurance amount upfront, in one lump sum. It results in a lower monthly mortgage payment, compared to paying PMI monthly, which may help a buyer qualify for a more expensive home. It is also a less expensive alternative, over time, than paying the premium monthly.

For Realtors, you can sell more homes by having your customers use our flexible mortgage programs which allow more buyers to purchase homes and feature affordable payment options.

Interest Rates Still at Historic Lows

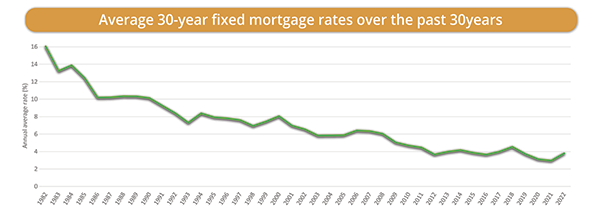

While the pandemic spurred a dramatic low interest rate environment, current interest rates remain at historic low levels (see chart below).

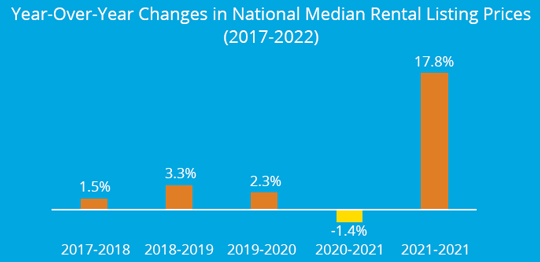

Now is still a great time for potential homeowners to take advantage of low rates and fabulous properties and become homeowners. And remember, mortgage interest is tax deductible* while rent payments are not! And rental prices are on the increase which is making it more expensive to rent (see 2nd chart below).

Call now to learn about the low-rate, flexible mortgage programs we offer to help customers become homeowners.